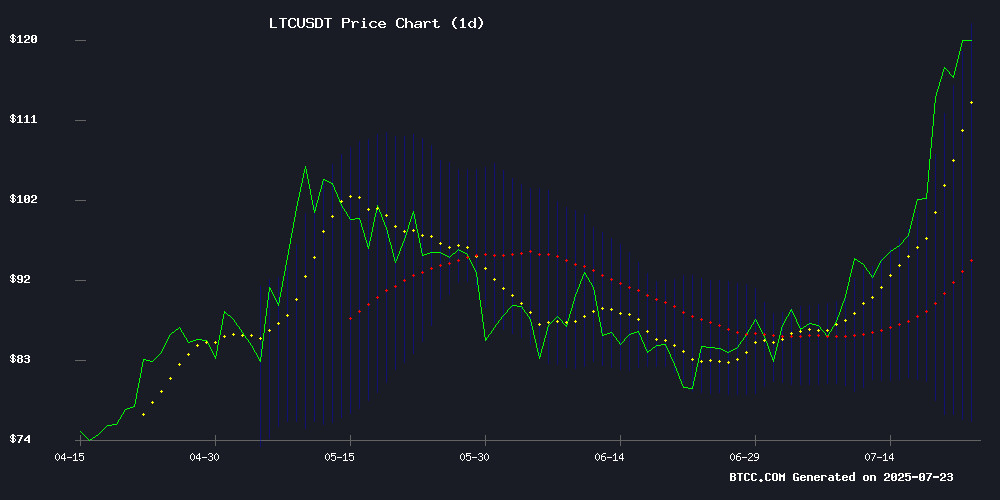

LTC Price Prediction: Analyzing the Bullish Case at $116

#LTC

- Technical Strength: LTC maintains 17% premium above 20-day MA with improving momentum indicators

- Market Context: Regulatory progress for major tokens contrasts with memecoin speculation

- Key Level: 120.82 upper Bollinger Band represents immediate resistance

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Above Key Moving Average

Litecoin (LTC) is currently trading at, firmly above its 20-day moving average (98.8310), signaling bullish momentum. The MACD histogram (-3.9333) shows narrowing bearish divergence, while price hovers NEAR the upper Bollinger Band (120.8248), suggesting potential overbought conditions.notes BTCC analyst James.

Crypto Market Sentiment: Regulatory Wins Offset Memecoin Speculation

While memecoin derivatives frenzy dominates headlines, regulatory progress for XRP ETFs creates a mixed backdrop.says James of BTCC,The market appears bifurcated between utility tokens and speculative assets.

Factors Influencing LTC's Price

Fartcoin Derivatives Frenzy Highlights Speculative Excess in Memecoin Markets

Fartcoin (FARTCOIN), a Solana-based memecoin, has surged into the top ten cryptocurrencies by derivatives open interest with over $1 billion in notional futures contracts. This places the joke token ahead of established assets like Litecoin (LTC), Chainlink (LINK), and Avalanche (AVAX) – projects with tangible utility in DeFi, oracles, and payments.

The derivatives activity is disproportionate to Fartcoin's fundamentals. Open interest equals 65% of its $1.62 billion market cap, compared to Bitcoin's 3.5% ratio against its $2.36 trillion valuation. Such extreme leverage typically signals retail-driven speculation during bull markets, with traders chasing high-risk, low-cap assets.

Data from Alphractal confirms this pattern extends across smaller tokens. "From the Top 300 down..." the report notes, suggesting a broader market trend where speculative appetite outweighs fundamental valuation.

Bitwise's XRP-Weighted ETF Gets SEC Approval But Faces Regulatory Halt

The SEC granted Bitwise approval to convert its crypto index fund into a diversified ETF with notable XRP exposure—only to abruptly pause its launch under Rule 431(e). The fund’s 78.7% Bitcoin and 11.1% Ethereum allocations comply with SEC guidelines, while its 4.97% XRP stake and smaller altcoin holdings mark a rare regulatory concession.

Investors anticipating exposure to Solana, Cardano, and Chainlink through traditional markets now face uncertainty. Bitwise’s planned monthly rebalancing would have offered dynamic altcoin access, but the stay underscores the SEC’s lingering reservations about non-Bitcoin crypto products.

Shiba Inu Price Predictions: Potential Rally to $0.000308 or $0.00409

Shiba Inu (SHIB) continues to captivate investors with bold price predictions, despite recent market fluctuations. Analysts project potential targets of $0.000308 or even $0.00409, though the timeline remains speculative. The meme coin currently trades above $0.000015, weathering a minor 0.73% dip amid broader market movements.

Market dynamics shifted as Litecoin (LTC) surpassed SHIB in capitalization rankings, fueled by a 16.05% daily surge. SHIB now occupies the 19th position globally with an $8.94 billion valuation, demonstrating the volatile nature of altcoin hierarchies. This repositioning occurs despite SHIB's brief ascendancy during July's market-wide rally.

Investor sentiment appears undeterred by ranking changes, with some anticipating a parabolic move that could erase two decimal places from SHIB's valuation. The asset's community-driven momentum and historical volatility suggest such targets, while ambitious, remain within the realm of crypto market possibilities.

Is LTC a good investment?

LTC presents a compelling case based on current technicals and market structure:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +17.7% premium | Strong uptrend |

| Bollinger Position | Upper band 120.82 | Potential resistance |

| MACD | Converging | Momentum shift |

James cautions: "While the breakout is technically valid, investors should watch for consolidation near 120 USDT resistance." The lack of LTC-specific news creates cleaner price action versus meme-driven assets.

Past performance not indicative of future results